Credit Cards

Surge Mastercard® card application

The Surge Mastercard® card is a credit card designed specifically for people with bad credit to help them improve their scores. Learn more about the card and how to apply.

Advertisement

Surge Mastercard® card: Fast and easy online application!

The Surge Mastercard® card is a solid option for people with bad credit to repair their history. Issued by Celtic Bank and serviced by Continental Finance, cardholders can use the Surge card anywhere Mastercard is accepted.

This is an unsecured card, which means clients don’t need to put down a security deposit in order to get a spending limit. However, the initial credit limit (between $300 and $1,000) varies based on creditworthiness.

With monthly payment reports to Experian, Equifax and TransUnion, clients can repair their damaged score by paying their bills on time and not using all of their credit limit. Paying their bill on time may also double their spending limit in just 6 months.

Surge charges an annual fee between $75 and $99 based on creditworthiness. There are no monthly fees during the first year of card usage, but the company charges up to $10 after that. That fee is waived for clients with a limit between $750 and $1,000.

The Surge Mastercard® card has a variable APR that ranges between 24.99% and 29.99%. Therefore, it’s important to not carry a balance to avoid paying a high interest. With its fast application process, clients can know if they pre-qualify in seconds. Read on to learn how to apply for this card.

Learn how to apply online

You can apply for a Surge Mastercard® card online in just a few easy steps. First, you have to access the Continental Finance – the company that provides the product – website.

Then, click on the “menu” bar at the top right corner of your screen and select “credit cards”. The page will present you with a selection of products offered by the company and you’ll have to scroll down until you find the Surge option.

By clicking on “apply now”, you’ll have to fill in an online form for the pre-qualification. This part of the process will determine your spending limit based on your financial history.

If all the information is correct and you agree with the company’s terms, follow the steps required by Continental Finance to finish the application form and click “send”.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Learn how to apply using the app

Clients get free 24/7 account access to manage their credit cards. Surge allows cardholders to view their balances, pay their bills and check their limit via mobile easily. However, all new applications have to go through their official website. The company grants access to its mobile app after the card’s been activated.

What about another recommendation: Secured Sable ONE credit card

If you feel unsure about requesting a Surge Mastercard® card and want to look at other options before making a decision, check out the Secured Sable ONE credit card! Even though the Sable ONE is a secured card, cardholders are not required to put down a minimum deposit.

With a low APR and cash back rewards, maybe the Sable ONE is the card you’ve been looking for afterall.

Check some of its features below and proceed to the following link for more information about the card’s application process.

- Sign-up bonus: There’s no sign-up bonus.

- Annual fee: This card charges no annual fee.

- Rewards: 1% – 2% cash back.

- Other perks: Low interest rates and no credit check.

- APR: 11.74% variable.

How to get the Secured Sable ONE credit card?

Learn the application process for the Secured Sable ONE credit card and see just how fast you can start your progress towards financial freedom!

About the author / Aline Barbosa

Trending Topics

Ally Invest application

Learn all about the Ally Invest online application and how you can easily open an account to start trading immediately.

Keep Reading

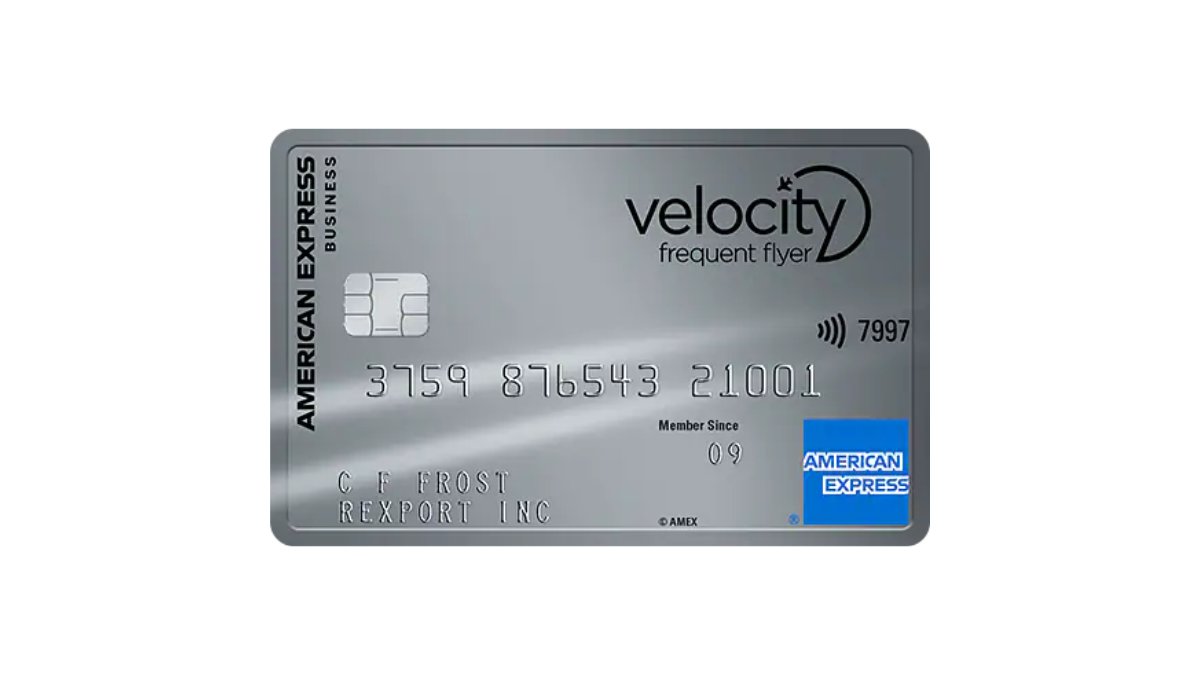

American Express® Velocity Business Card Review: Earn more

Soar into the world of business travel! Explore every feature of the American Express® Velocity Business Card in this review. Earn points!

Keep Reading

ANZ Personal Loans review: Your Key to Turning Dreams into Reality

Looking for a reliable lender? ANZ personal loans offer competitive rates and a trusted reputation. Borrow up to $50K easily!

Keep ReadingYou may also like

FIT® Platinum Mastercard® review: is it worth it?

Discover all of the benefits and features of the FIT® Platinum Mastercard® and improve your credit score with this powerful card!

Keep Reading

What is the difference between a secured and unsecured credit card

If you are wondering what the difference between secured and unsecured credit cards is, you have come to the right place. Find out now!

Keep Reading

4 best prepaid cards to control your budget

Are you looking for a card to help you keep track of your money? Here are our picks for the best prepaid cards to control your budget.

Keep Reading